Indiana Motor Fuel Tax Rates

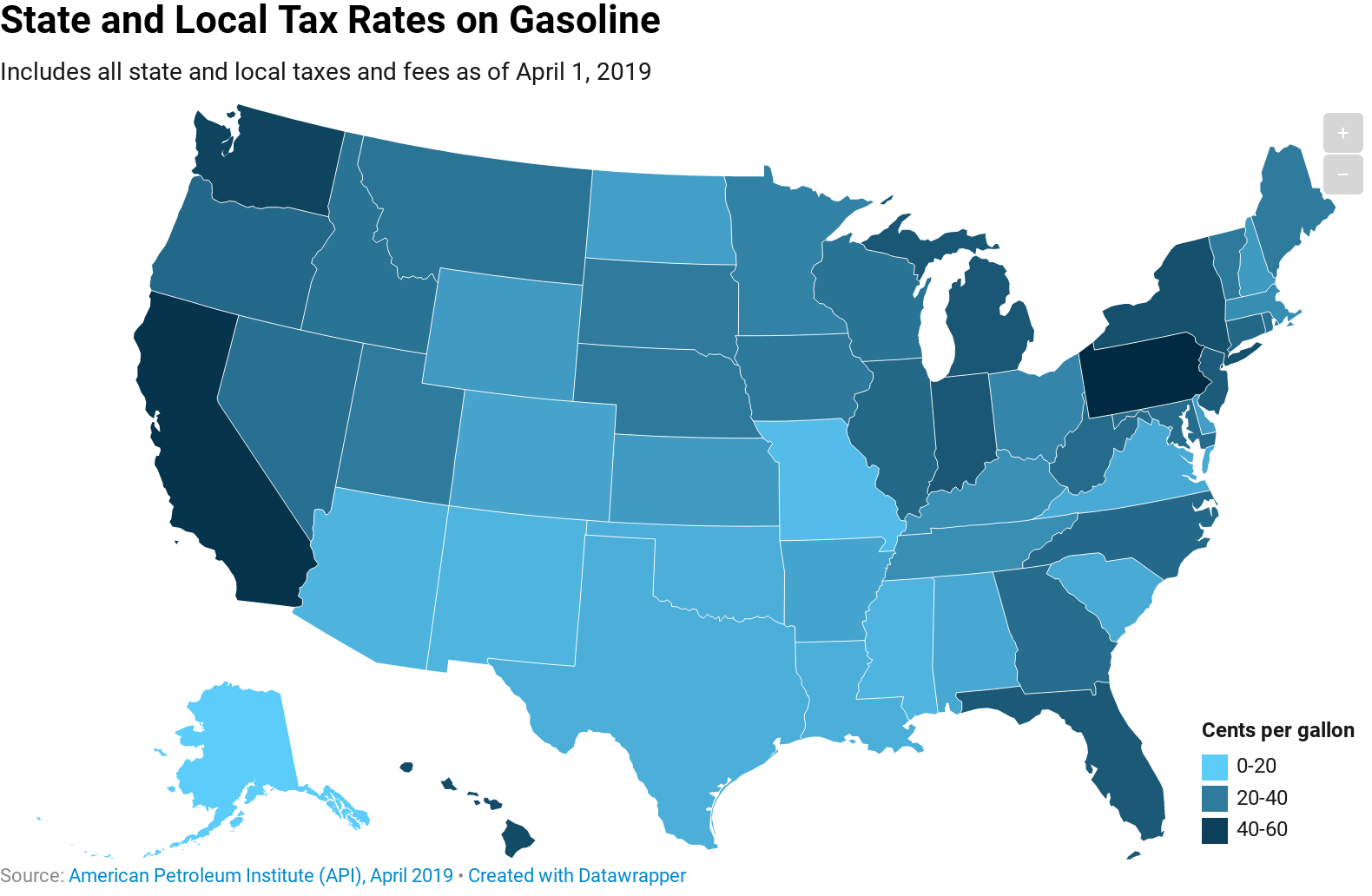

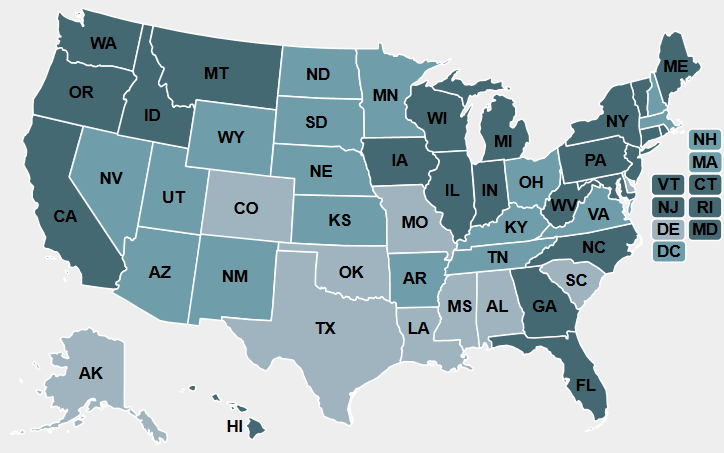

Indiana Motor Fuel Tax Rates. Have diesel taxes lower than the average. However, the motor fuel tax increase cannot be greater than 8% of the motor fuel tax rate effective in the previous year.

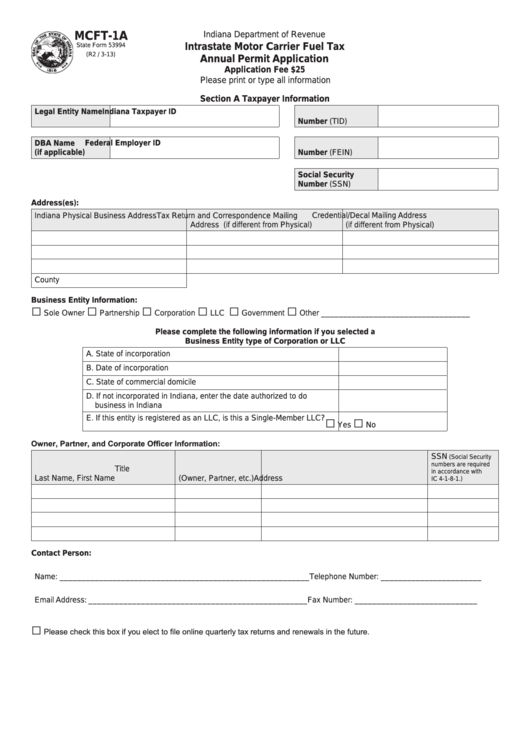

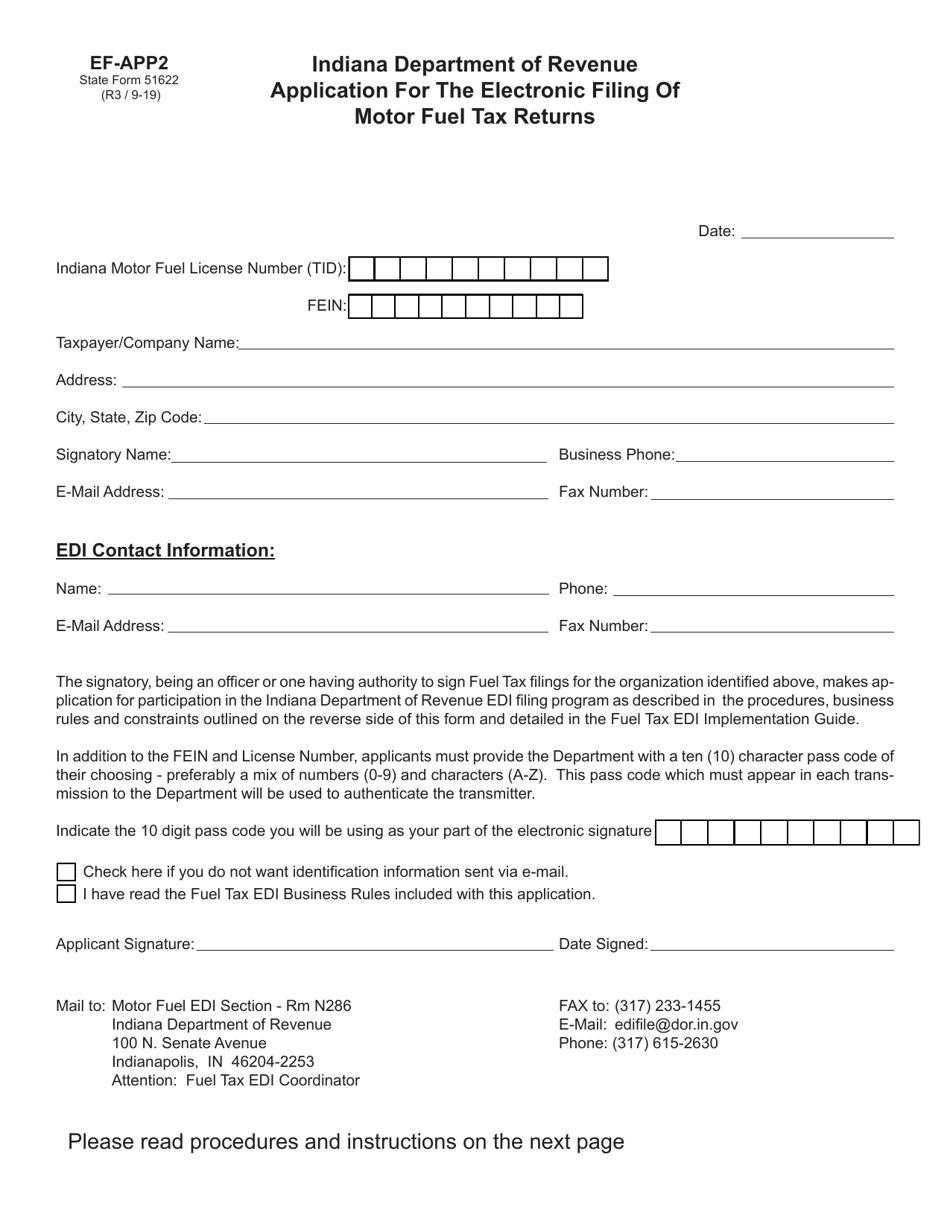

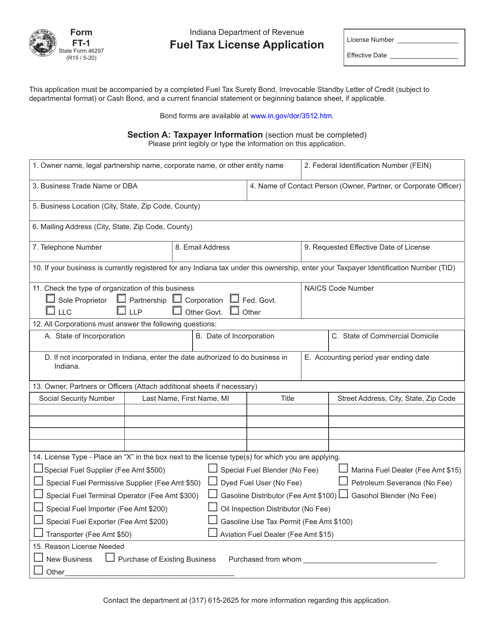

Motor Fuel Taxes Urban Institute from www.urban.org

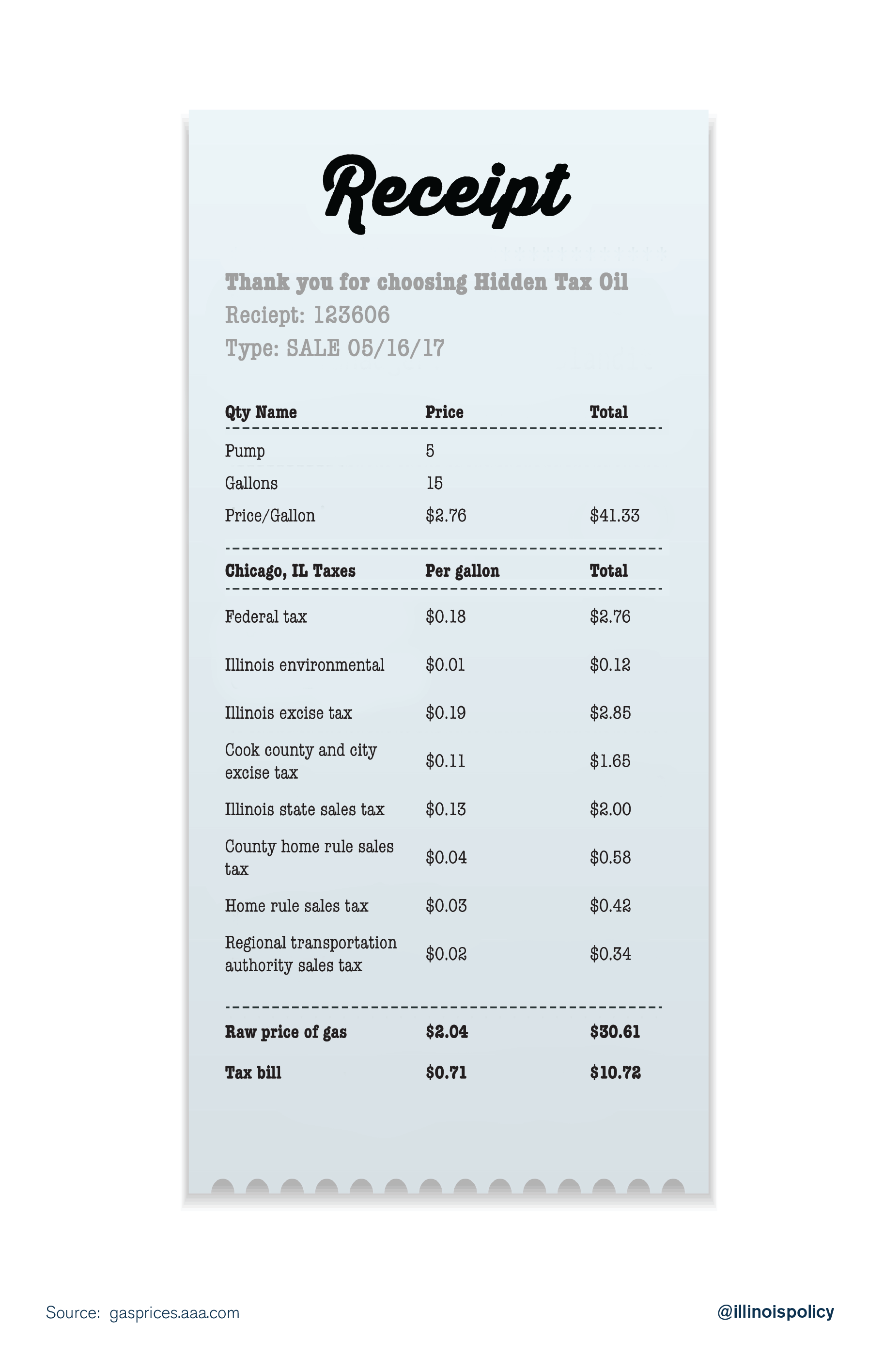

Motor Fuel Taxes Urban Institute from www.urban.orgAs the use of motor fuels is different so too are the tax rates. The rate is $0.205 per gallon for all special fuels with the exception of liquefied petroleum gas (lpg), liquefied natural gas (lng) and compressed natural gas (cng). /8 diesel rate specified is the fuel use tax rate on large trucks.

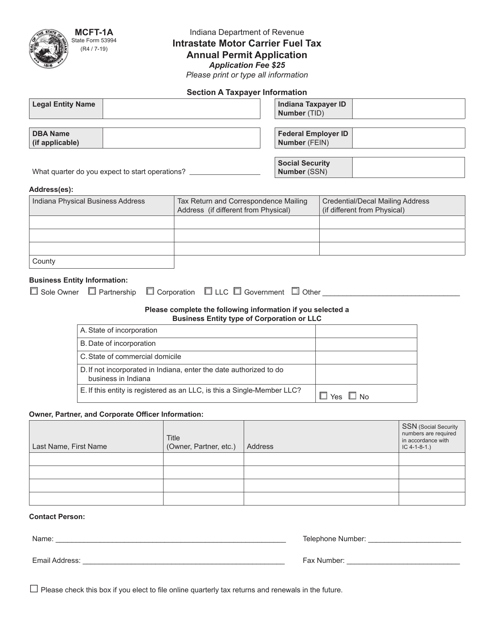

However, the motor fuel tax increase cannot be greater than 8% of the motor fuel tax rate effective in the previous year. If the highway vehicle that uses the motor fuel is owned by or leased to a motor carrier, the operator of the highway vehicle and the motor carrier are jointly and severally liable for the tax.

The rate is $0.205 per gallon for all special fuels with the exception of liquefied petroleum gas (lpg), liquefied natural gas (lng) and compressed natural gas (cng). Special fuel rate table transaction date tax rate periods prior to july 1, 2017 $0.16 per gallon july 1, 2017 through june 30, 2018 $0.26 per gallon july 1, 2018 through june 30, 2019 $0.48 per gallon july 1, 2019 through june 30, 2020 $0.49 per gallon july 1, 2020 through june 30, 2021 $0.51 per gallon periods on or after july 1, 2021 $0.53 per gallon

Diesel subject to a 13% sales tax. The tax rates per gallon or gasoline gallon equivalent are:

Motor fuel tax assessment (mfta) applies to gasoline only: Lng and propane are taxed per.

Enter the total refund claim by multiplying column 7 by column 8 and summing the refunds claimed on each line. And mo will increase to 22 cents per gallon.

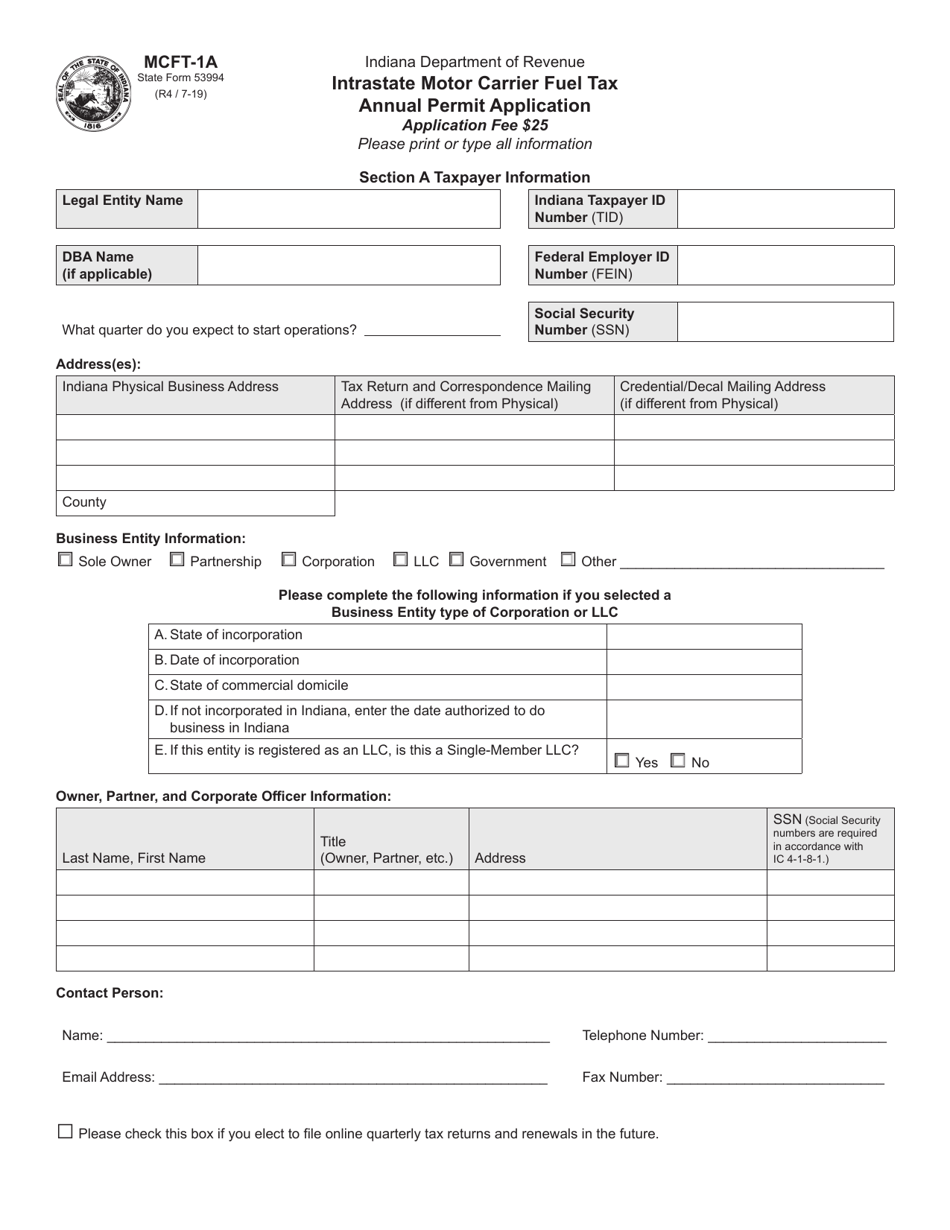

Motor fuel tax rates 2021 author: From july 1, 2021, to june 30, 2022, the rate of the mcft is $0.53 per gallon of special fuel or alternative fuel, and $0.32 per gallon of gasoline, consumed by a carrier in its operations on highways in indiana.

In indiana, aviation fuel is subject to a state excise tax of $0.18 +$0.01 oil inspection fee + $0.10 aviation fuel excise tax. Small vehicles are subject to 18 cent tax rate.

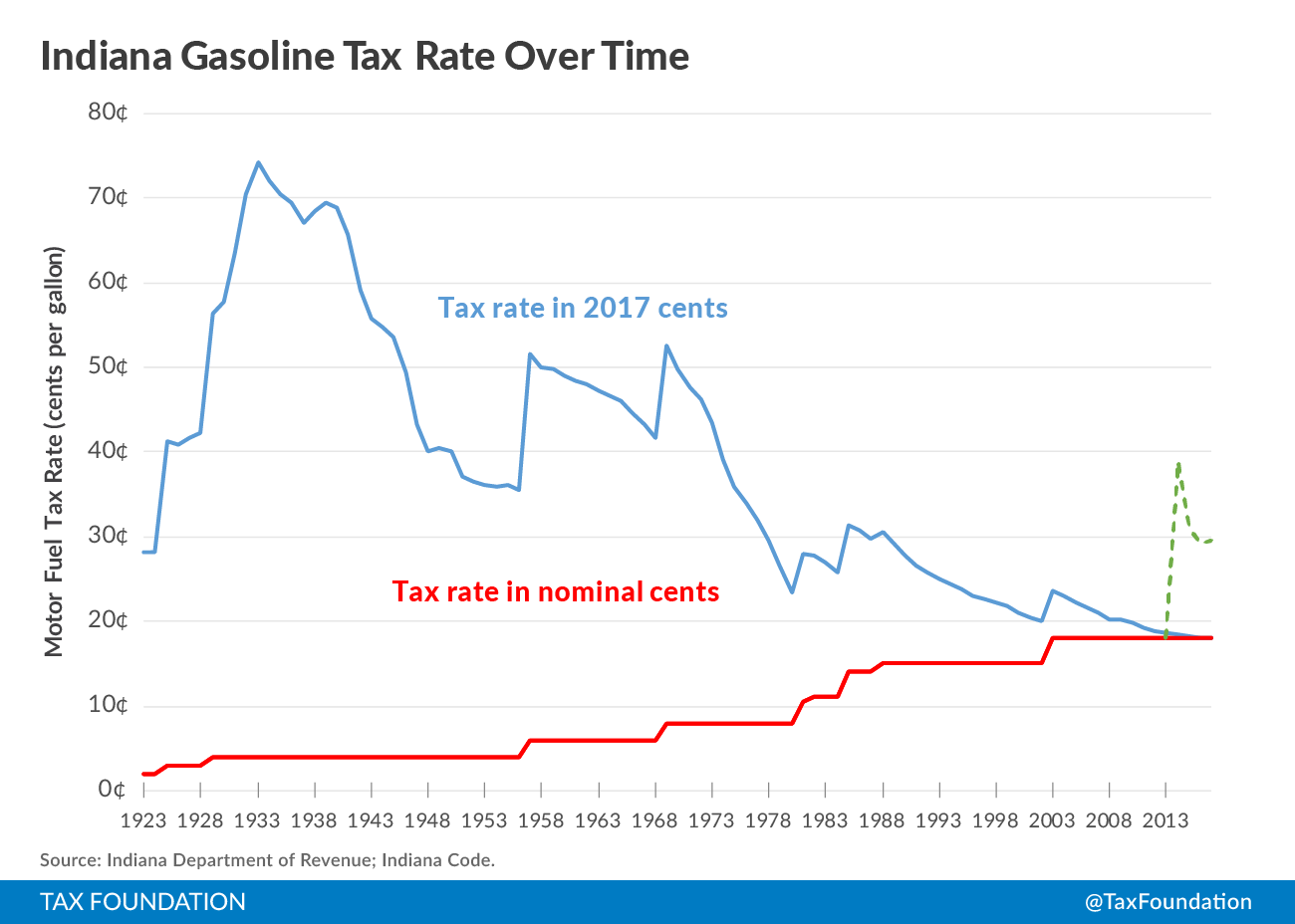

2021 combined applicable motor fuel tax rates per gallon effective july 1, 2021 created date: $0.24 from july 1, 2017 to june 30, 2018.

$0.24 from july 1, 2017 to june 30, 2018. Current gasoline excise tax rate is $.24 per gallon and the current undyed diesel fuel excise tax rate is $.25 per gallon.

From july 1, 2021, to june 30, 2022, the rate of the mcft is $0.53 per gallon of special fuel or alternative fuel, and $0.32 per gallon of gasoline, consumed by a carrier in its operations on highways in indiana. Even if you have a net refund, interest still applies to each jurisdiction for any underpayment of fuels use tax to that jurisdiction and is calculated beginning the day after the due date of the return for each month, or fraction of a month, until paid.

Other fuel (like avia gasoline, jet fuel, heavy oils, natural gas and autogas) prices has no excise tax. This information is updated weekly with the indiana department of revenue.

From july 1, 2021, to june 30, 2022, the rate of the mcft is $0.53 per gallon of special fuel or alternative fuel, and $0.32 per gallon of gasoline, consumed by a carrier in its operations on highways in indiana. Have diesel taxes lower than the average.

Special fuel rate table transaction date tax rate periods prior to july 1, 2017 $0.16 per gallon july 1, 2017 through june 30, 2018 $0.26 per gallon july 1, 2018 through june 30, 2019 $0.48 per gallon july 1, 2019 through june 30, 2020 $0.49 per gallon july 1, 2020 through june 30, 2021 $0.51 per gallon periods on or after july 1, 2021 $0.53 per gallon And mo will increase to 22 cents per gallon.

The tax is due on gross gallons acquired. Motor fuel tax rates 2021 keywords:

Small vehicles are subject to 18 cent tax rate. $0.25 from july 1, 2018 to june 30, 2019.

Have diesel taxes lower than the average. Diesel subject to a 13% sales tax.

Excise tax on motor fuel was 25.64 cents per gallon of gasoline and 26.25 cents per gallon of diesel fuel. Enter the total refund claim by multiplying column 7 by column 8 and summing the refunds claimed on each line.

Current gasoline excise tax rate is $.24 per gallon and the current undyed diesel fuel excise tax rate is $.25 per gallon. $0.26 from july 1, 2019 and after.

Even if you have a net refund, interest still applies to each jurisdiction for any underpayment of fuels use tax to that jurisdiction and is calculated beginning the day after the due date of the return for each month, or fraction of a month, until paid. If the highway vehicle that uses the motor fuel is owned by or leased to a motor carrier, the operator of the highway vehicle and the motor carrier are jointly and severally liable for the tax.

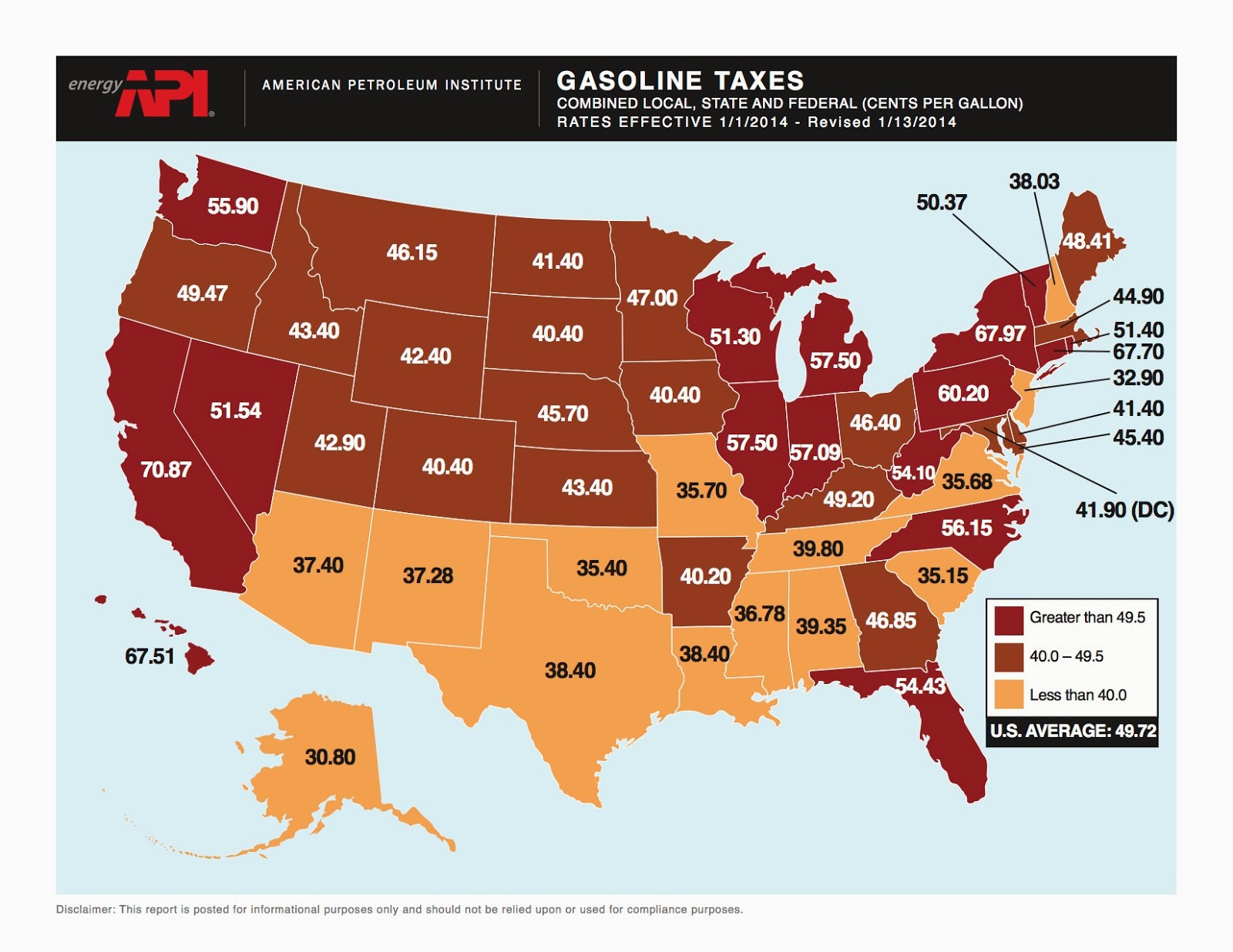

1 this list includes rates of general application (including, but not limited to, excise taxes, environmental taxes, special taxes, and inspection fees), exclusive of county and local taxes. Motor fuel tax rates 2021 keywords:

In Indiana, Aviation Fuel Is Subject To A State Excise Tax Of $0.18 +$0.01 Oil Inspection Fee + $0.10 Aviation Fuel Excise Tax.A tax is imposed on diesel fuel when it crosses the terminal rack or upon import from a facility below the terminal bulk system. This increase took effect july 1, 2013, and may increase each july 1st thereafter. From july 1, 2021, to june 30, 2022, the rate of the mcft is $0.53 per gallon of special fuel or alternative fuel, and $0.32 per gallon of gasoline, consumed by a carrier in its operations on highways in indiana.

In States Where Taxes Vary Depending Upon The Price Of The Motor Fuel (For Example, Where The Tax Rate Is Set As A Percentage Of The Sales Price Rather Than A Cents Per Gallon Method), The State Average Listed On The Chart Is A Snapshot Based Upon The Price Of Fuel (As Reported By Aaa) On The Date The Chart Is Updated.$0.24 from july 1, 2017 to june 30, 2018. Fuel tax product code matrix; The inspection fee rates are $.02 per gallon for dyed diesel fuel, $.01 per gallon for dyed kerosene, and $.15 per gallon for lubricating oil.

The Indiana Gas Tax Is Included In The Pump Price At All Gas Stations In Indiana.Have diesel taxes lower than the average. Effective october 2015, all motor fuel returns are required to be filed electronically via the ohio business gateway (business.ohio.gov).all active license and registration holders must submit returns which include applicable schedules for receipts, disbursements and inventory. For a nominal fee of $400, this new program will allow an ifta subscriber access to some great features on our website and other benefits only available to ifta subscribers.

The Tax Rates Per Gallon Or Gasoline Gallon Equivalent Are:Hydrogen fuel will have a tax rate of $0.65 per gallon beginning january 1, 2020. Special fuel $0.53 gasoline $0.32 alternative fuel $0.53 column 9: 2021 combined applicable motor fuel tax rates per gallon effective july 1, 2021 created date:

The Average Diesel Tax By State Is $0.3119, Higher Than The Average Gas Tax.$0.20 per gallon until june 30, 2017. Today, the federal tax rate on diesel is 6 cents higher ($0.244/gallon) than gasoline ($0.1844/gallon) in large part to account for the greater weight of commercial vehicles and "wear and tear" imposed on transportation infrastructure by commercial vehicles. Motor fuel tax rates 2021 author:

Belum ada Komentar untuk "Indiana Motor Fuel Tax Rates"

Posting Komentar